harrisburg pa local services tax

Nonresidents who work in Harrisburg also pay a local income tax of 100 the same as the local income tax paid by residents. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

Popular Pretty Flower Background 2560x1600 Bloem Achtergrond Bloem Behang Zomerbloemen

60 Harrisburg East Mall.

. All employers must submit the following information. 0 appointments available today. First theres the fact that the citys main employer the state government pays no property.

If the total LST rate enacted exceeds 1000 the tax will be deducted at a rate of 100 per week. Earned Income Tax Regulations. Local Withholding Tax FAQs - PA Department of Community Economic Development Local Withholding Tax FAQs DCED Local Government Services Act 32.

1 717 545-6385 5721 Jonestown Rd Harrisburg PA 17112. HARRISBURG- Harrisburg city council members Wednesday night approved a hike in the local services tax that raises the amount to 3 per week up from 1 per week. HARRISBURG A brand new interactive feature on the City of Harrisburg website put your city and school tax values one click away.

3300a Paxton St Harrisburg PA 17111 CLOSED NOW From Business. Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone. KJM Income Tax Services is dedicated to providing a economy-friendly fee of 15000 per return 50 per return for clients with no dependents other bank 10.

Employer Online Filing and Payroll Companies Submitting Information Electronically. 100 tax rate for nonresidents who work in Harrisburg Residents of Harrisburg pay a flat city income tax of 100 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Mahers Tax Service Tax Return Preparation-Business 45 YEARS IN BUSINESS 717 836-2175 2732 Colonial Rd Harrisburg PA 17112.

Your Harrisburg tax preparation office. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year. 2nd St Harrisburg PA 17101.

This is the date when the taxpayer is liable for the new tax rate. Harrisburg is in the following zip codes. A total of 156 a year to support the services I consume or might needroads police fire health inspections etcover some 2000 annual working hours seems like a fair price to pay.

Go to Harrisburg PA Local Harrisburg PA Featured Businesses. Tuesdays and Wednesdays 830am to 230pm. All fields marked with an asterisk are required.

Select Payment Category Please make a selection from the menu below to proceed. The Property Tax Viewer available on the Harrisburg City Treasurers page on HarrisburgPAgov allows anyone to see what they will be paying in city and school taxes this year. Member Tax Rates.

17101 17102 17103. See reviews photos directions phone numbers and more for the best Tax Return Preparation in Harrisburg PA. Each payment is processed immediately and the date is equal to the time you completed the transaction.

The current total local sales tax rate in Harrisburg PA is 6000. The tax hike is. TAXES 15-34 Pennsylvania Cities Local Services Tax LST Previous Tax Formula Withholding Formula Effective Pay Period 13 2015 The Local Services Tax LST for cities in Pennsylvania is withheld on a mandatory basis from the salaries of employees whose duty stations are located in the cities listed below.

But in Harrisburg the situation is much more pressing. The name of the tax is changed to the Local Services Tax LST. List by School District.

3501 Paxton St Unit N4b. Local Income Tax Information Local Withholding Tax FAQs To connect with the Governors Center for Local Government Services GCLGS by phone call 8882236837. This tool is free for anyone to use said City.

Harrisburg also received authority to raise the tax under Act 47 from the Commonwealth Court of Pennsylvania. 800am to 400pm Weekends. Harrisburg is authorized to set the Local Services Tax rate at 156 per year under the state Financially Distressed Municipalities Act also known as Act 47.

The December 2020 total local sales tax rate was also 6000. Known to the Native Americans as Peixtin or Paxtang the area was an important resting place and crossroads for Native American traders as the trails leading from the Delaware to the Ohio rivers and from the Potomac to the Upper. Local Services Tax Information for Employers NOTE.

American Restaurants Bar Grills Family Style Restaurants Hamburgers Hot Dogs Restaurants Take Out Restaurants 717 652-3061 4401 Jonestown Rd Harrisburg 17109 Eatin Good in the. Employees full social security number full name full address and gross wages LST withheld for the quarter worksite PSD code and the. How to contact Seidel Betty Tax Service.

This service provided by Value Payment Systems allows you to pay your City of Harrisburg PA payments online. Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the political subdivision is. Local Services Tax Information for Employers.

Sales Tax Breakdown Harrisburg Details Harrisburg PA is in Dauphin County. Harrisburgs site along the Susquehanna River is thought to have been inhabited by Native Americans as early as 3000 BC. EFFECTIVE JANUARY 1 2016 ALL EMPLOYERS WITH 26 OR MORE EMPLOYEES WILL BE REQUIRED TO FILE ONLINE.

Pin By Raymond Whitacre On Oh I Love This City Hbg Pa Mechanicsburg Pa Harrisburg Pennsylvania Mechanicsburg Pennsylvania

Guide To Local Wage Tax Withholding For Pennsylvania Employers

Income Tax Assistance United Way Of Pennsylvania

Annual Event Funds Local Scholarships Delta Sigma Theta Sorority Delta Sigma Theta Central Pa

Pennsylvania Sales Tax Guide For Businesses

12242 Pa Splitting Tax Between School District And Municipality

Movers In Harrisburg Pa Sp Network Moving Local Moving Local Move Moving Services Moving Company

Deputy Tax And Enforcement Administrator City Of Harrisburg

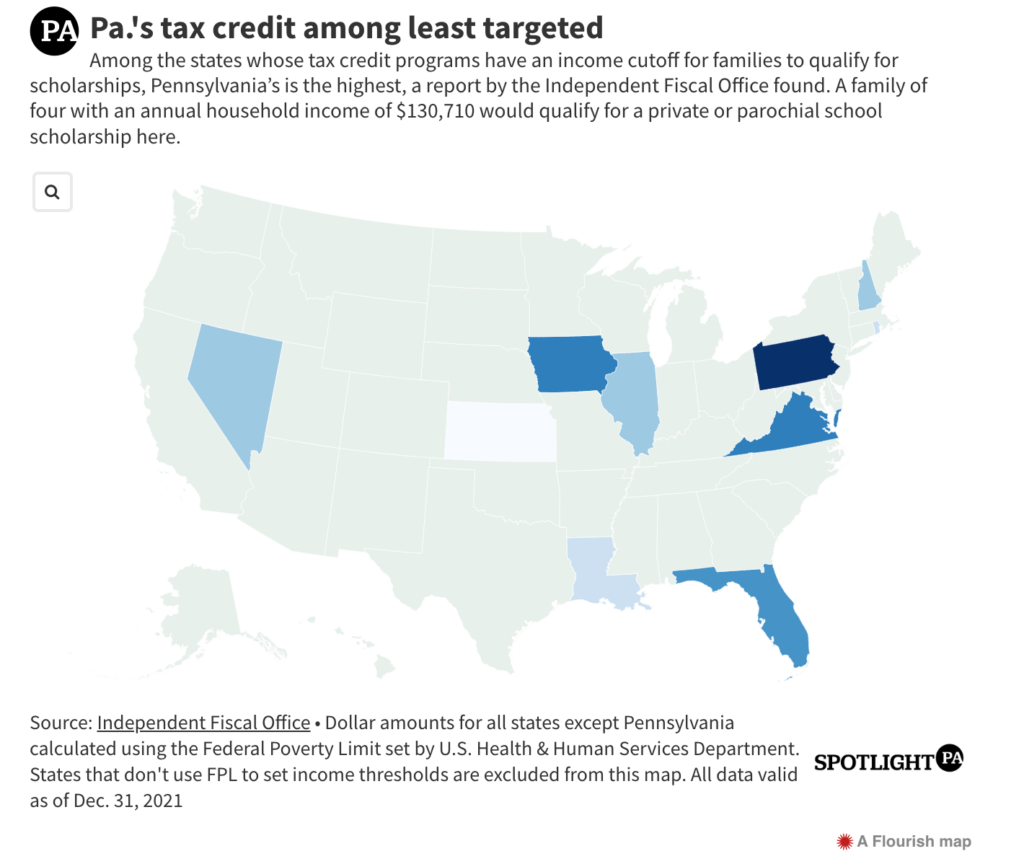

New Pa Budget Injects 125m Into Private School Tax Credit Program That Lacks Basic Accountability Whyy

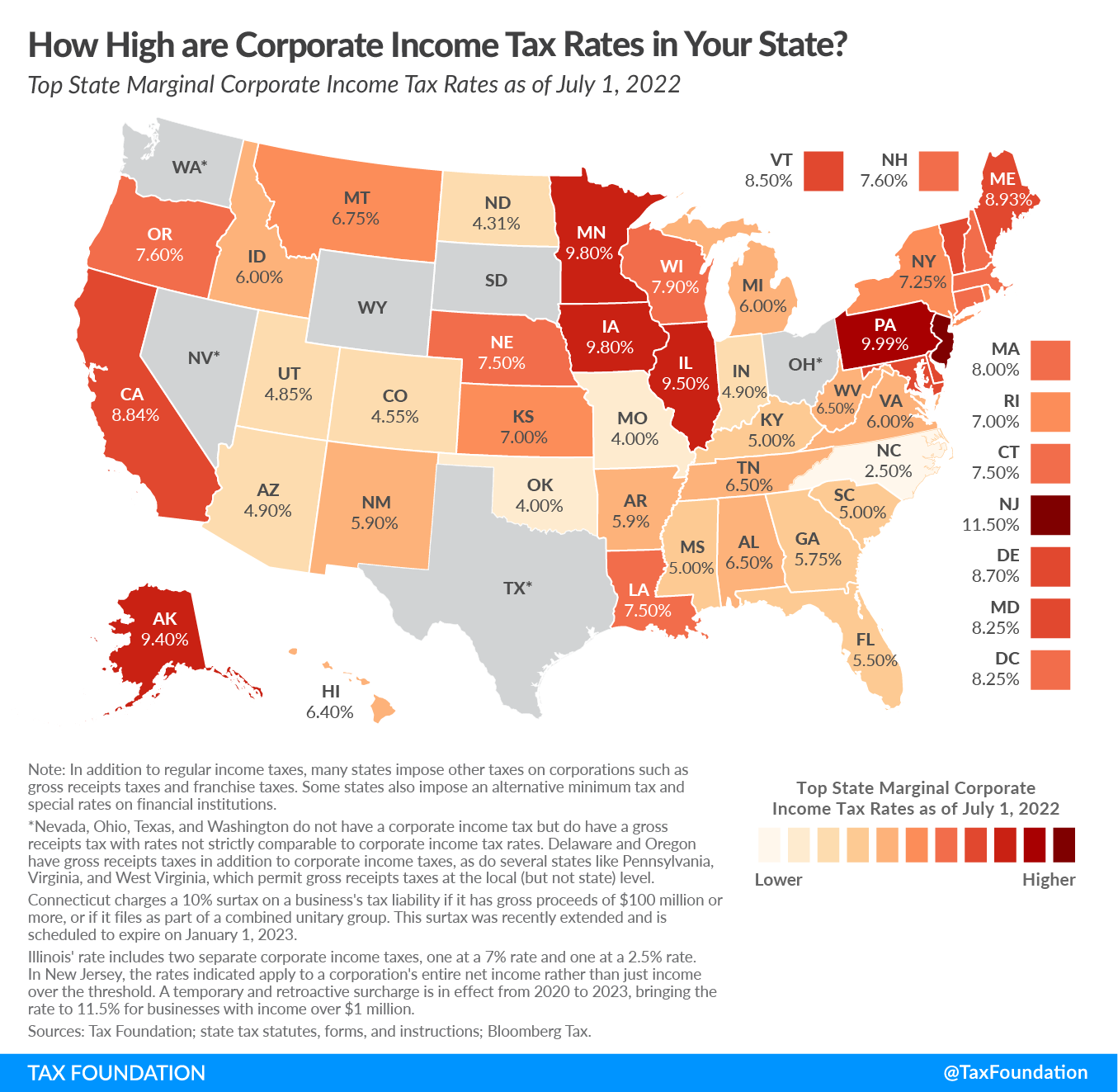

Pa Corporate Tax Cut Details Analysis Tax Foundation

Report Westmoreland Home To Western Pa S Tornado Alley Wildest Weather

Pa Taxpayers Encouraged To File State Returns With Free Online Option Pennsylvania News Wfmz Com

Pennsylvania Sales Tax Guide For Businesses

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

The Prior Service Entrepreneur Veteran Entrepreneurship And Lean Business Start Up 2nd Edition Ebook In 2021 Starting A Business Entrepreneur Start Up